Catalyzing finance and investment

for a sustainable and climate resilient future

Established in 2024, Climate Finance Network Thailand (CFNT) is a think tank and a network of like-minded individuals headquartered in Bangkok, devoted to propelling sustainable financial practices and assisting in Thailand’s transition toward a low-carbon economy.

Climate Finance in Thailand

Recognizing the pivotal role of the financial sector in combating climate change, CFNT’s primary objective is to help catalyze impactful climate finance through solution-based research, stakeholder engagement, and network building. Our ultimate goal is to assist Thailand’s financial sector to be more responsive to the challenges of climate change. By uniting forces with like-minded partners, CFNT endeavors to help shape a financial landscape that aligns with global sustainability goals and fosters a resilient, green, and inclusive economy.

Event

Join us for the ‘Mobilising Climate Finance for a Climate Resilient Bangkok’ in BKK CAW

September 30, 2025 l 09:00 – 13:00 AM (Bangkok Time)

The Society, 22nd Floor, Gaysorn Tower, Bangkok

During Bangkok Climate Action Week, Climate Finance Network Thailand (CFNT) will host an event to deliberate how comprehensive insights into finance flows can support climate adaptation and mitigation outcomes in hashtagBangkok and similar dense urban settings.

Research Highlights

Can Chinese EV InvestmentContribute to Thailand’s Green Transformation?

This report examines the governance structures and local implications of Chinese electric vehicle investment in Thailand. It intends to provide an evidence-based reference point for policymakers and stakeholders in both countries, for future research, analysis, and action towards a more inclusive, trusted, and equitable form of sustainable development.

Here Comes Everybody: Boosting Residential Solar Financing with Crowdfunding Models in Thailand

Thailand has abundant solar resources, but its utilization of solar energy falls short of its potential. This report explores crowdfunding as an alternative financing mechanism to bridge gaps in residential solar photovoltaic (PV) funding. We propose several financing models tailored to the Thai context, including Pay-As-You-Save (PAYS), which enables consumers to install solar PV systems […]

A Better Path is Possible Critique and Suggestions to Draft PDP2024

In this report, we critically analyze draft Power Development Plan 2024 (PDP2024), emphasizing its over-reliance on fossil fuels, particularly natural gas, and the high associated costs and risks. Despite Thailand’s commitment to achieving carbon neutrality by 2050, the plan prioritizes the development of new gas plants and unproven technologies such as Small Modular Reactors (SMRs) […]

Thailand’s Fossil Lock-In: Stranded Risk of Midstream Oil & Gas Infrastructure

This report examines the financial risks of Thailand’s continued investments in midstream oil and gas infrastructure, including refineries and LNG terminals. As the world shifts towards net-zero emissions, these infrastructures face significant economic risks. The report details investment costs, with 189 billion THB for new oil refineries and 66 billion THB for new LNG terminal […]

Fossil Reckoning: Valuation of Coal and Gas Stranded Assets in Thailand

This research aims to evaluate the financial impact of Thailand’s transition to clean energy focusing on the potential stranded asset values within the gas and coal powerplant industry. Employing the Discounted Cash Flow (DCF) methodology, our analysis encompasses three scenarios: (1) Base Case or Power Development Plan 2018 Revision 1, (2) Rapid Transformation, and (3) […]

Articles

Climate finance for urban resilience

Thailand has made progress in disaster preparedness since the 2011 mega floods — but the real challenge now is shifting from disaster prevention to climate adaptation.

Panel Summary: “Financing Climate Action in Bangkok –Challenges & Opportunities”

Summary a panel discussion ‘Financing Climate Action in Bangkok –Challenges & Opportunities,’ featuring international experts on climate finance, who deliberated on the key barriers to increasing climate financing, lessons learned from global experiences, and insights for strengthening resilience in Bangkok and other major Asian cities facing climate change.

How Thailand’s Local Governments Invest in a Climate Change?

Thailand is one of the most vulnurable country in climate chage, a key question arises: How is Bangkok and other local governments allocating their budgets to address climate change, and how far are we from meeting the country’s climate finance goals?

Join for ‘Climate Action Investigate Training’

Join for ‘Climate Action Investigate Training’ deepen your expertise in investigating corporate climate actions. — designed to strengthen accountability and transparency in Thailand’s private sector environmental practices.

Join CFNT as a Research Fellow (12-Month Program)

Join CFNT as a research fellowship for 12-month to contributes meaningful and strengthening the climate finance ecosystem.

Feeding the Nation, Starved of Support: Thai Farms Left Behind in the Green Transition

Thailand has set bold climate goals. Yet we keep overlooking a sector at the heart of survival: agriculture, the feeding of nations.

Media

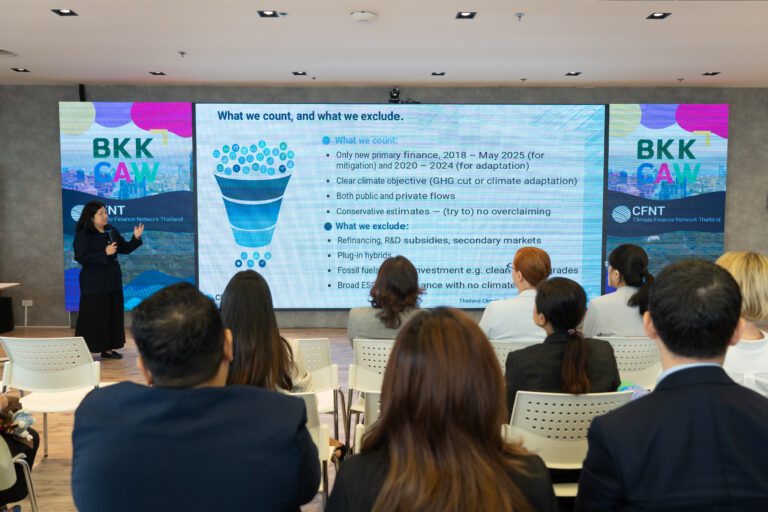

CFNT HOSTS EXPERT-LED CLIMATE FINANCE DISCUSSIONS DURING INAUGURAL BKK CAW

CFNT HOSTS EXPERT-LED CLIMATE FINANCE DISCUSSIONS DURING INAUGURAL BKK CAW

CFNT Webinar Series: Can Chinese EV Investment Contribute to Thailand’s Green Transformation?

How much can Chinese EV investment truly contribute to Thailand’s green transformation? Let’s find the answers in our online seminar.

CFNT LAUNCHES THAILAND’S FIRST CLIMATE FINANCE TRACKER

Full video of CFNT launch “Thailand Climte Finance Tracker” event.

CFNT Webinar Series – Phasing out coal: Case studies from Germany

On April 3, 2025, Climate Finance Network Thailand (CFNT) hosted a webinar titled “Phasing out coal: Case studies from Germany” The webinar featured Suchart Klaikaew, Program Lead for Innovation Regions for a Just Energy Transition (IKI JET) Thailand and an experienced Just Energy Transition Expert at GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit), Germany’s main development […]