Thailand is facing mounting challenges from climate change. The country’s ranking among the top 30th climate-vulnerable nations according to the Climate Risk Index, the impacts remain severe — from floods and droughts to coastal and riverbank erosion.

In recent years, Thailand has started to respond with plans and investments from both the public and private sectors to tackle greenhouse gas emissions and climate change impacts. However, what has been missing is a comprehensive financial tracking system and consolidated data on climate finance flows. Currently, information on climate-related funding remains fragmented or buried within various financial channels, making it difficult to determine exactly how much funding is available, which sectors are being supported, and whether financial targets are being met.

As Peter Drucker famously said: “You can’t manage what you don’t measure.”

This is the rationale behind the Climate Finance Network Thailand (CFNT) dedicating over a year to develop the Thailand Climate Finance Tracker, a first-of-its-kind tool designed to map the country’s climate finance landscape. It was officially launched on 21 July 2025 during the event “2025 Climate Finance Tracker: Uncovering Thailand’s Financial Flows.” CFNT hopes this tool will serve as a vital reference database and a hub connecting all stakeholders working on climate change issues in Thailand.

What is this tool? Why does Thailand need a systematic approach to data collection? And what key findings have emerged from this research? Below are 6 key takeaways from CFNT’s Climate Finance Landscape report.

Why Thailand Needs the Climate Finance Tracker

In recent years, numerous studies have confirmed that human activities are the main driver of global warming. Data from the World Meteorological Organization indicates that the global temperature has already surpassed the 1.5°C threshold, reaching 1.52°C — with 1.38°C attributed to human actions.

Climate impacts are becoming more severe and frequent. In 2024, for example, the U.S. experienced 1,796 tornadoes, while Spain faced devastating floods that claimed at least 232 lives. Extreme weather events like droughts, floods, and heatwaves are affecting communities worldwide.

For Thailand, Swiss Re estimates that if global temperatures rise by 2–2.6°C by 2048, the country could lose roughly 33.2% of its GDP. In a worst-case scenario of 3.2°C warming, Thailand’s economic losses could reach 43.6% of GDP.

Although Thailand has updated its climate targets — moving its net-zero goal from 2065 to 2050 — one fundamental question remains unanswered: “How much money has Thailand spent on climate action, and how much more is needed?”

“To this day, Thailand lacks a comprehensive picture of how much climate finance is being mobilized, where it comes from, and where it is going. This was the starting point of the 2025 Thailand Climate Finance Tracker project — to integrate this data and reveal the country’s climate finance landscape for the first time,” said Thanida Lawseriwanich, CFNT’s Head of Research.

What is the Thailand Climate Finance Tracker, and How Was It Developed?

The Thailand Climate Finance Tracker is a tool that monitors all financial flows related to climate action in Thailand. It is divided into two main areas:

- Climate Mitigation Finance:

Covers the period from 2018 to May 2025, tracking projects such as solar panel installations, EV charging infrastructure, and electric public transport. - Climate Adaptation Finance:

Covers the period from 2020 to 2024, focusing on projects like disaster early-warning systems, urban cooling through green spaces, and water management initiatives.

To build this database, CFNT’s research team analyzed over 3,500 projects from diverse funding sources, including:

- Government agencies

- State-owned enterprises

- Financial institutions

- Multilateral development banks (e.g., ADB)

- Multilateral climate funds (e.g., GCF)

- Domestic funds (e.g., ThaiCI)

However, the project faced key challenges such as limited access to public and private data, incomplete records, and ambiguous project objectives.

“I believe this is the clearest and most comprehensive climate finance landscape Thailand has ever seen. We aim to refine and expand this data in the coming years,” Thanida added.

6 Key Insights from Thailand’s Climate Finance Landscape

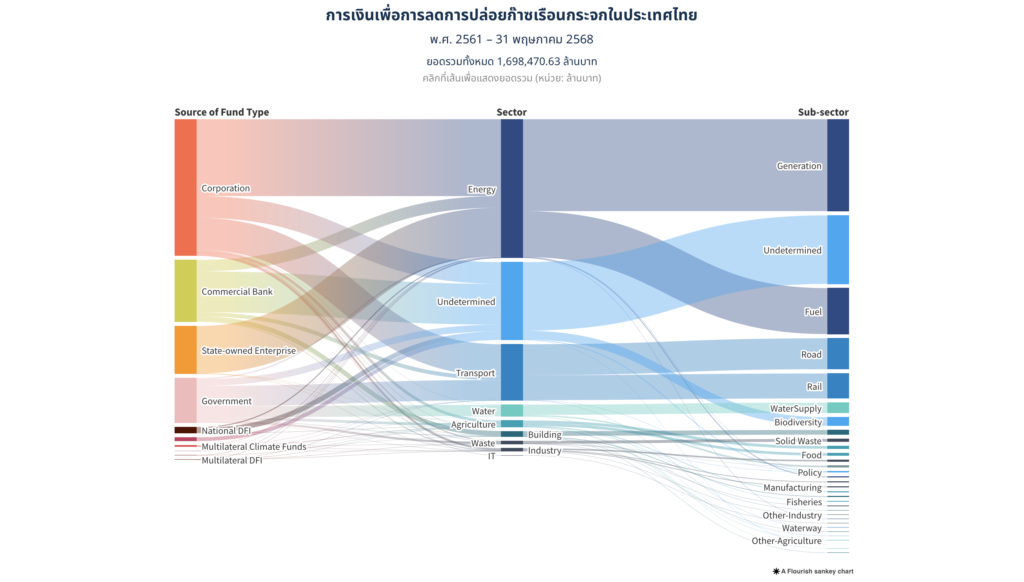

1. Thailand has invested 1.7 trillion THB in mitigation efforts.

Since 2018, CFNT estimates that 1.7 trillion THB has been invested in projects to reduce greenhouse gas emissions.

2. Energy is the top recipient of climate finance.

From 2018 to May 2025, the energy sector received the largest share of mitigation funding:

- 779.1 billion THB (45.9% of total mitigation finance), with projects like solar panel installations.

- Transport ranked third, with 315.1 billion THB (18.6%), for projects such as electric mass transit and EV charging stations.

Combined, the energy and transport sectors account for two-thirds of total mitigation finance.

3. Data gaps make 25.8% of funding “unclassified.”

The second-largest mitigation data category (437.7 billion THB or 25.8%) comprises funds that could not be clearly categorized due to insufficient data — highlighting the need for better reporting and transparency.

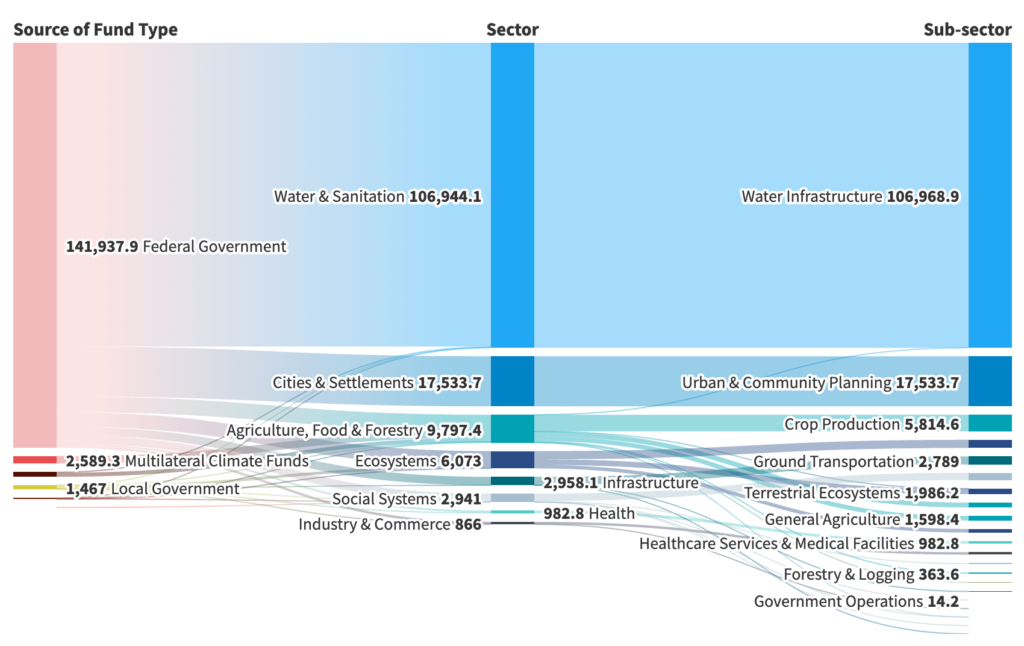

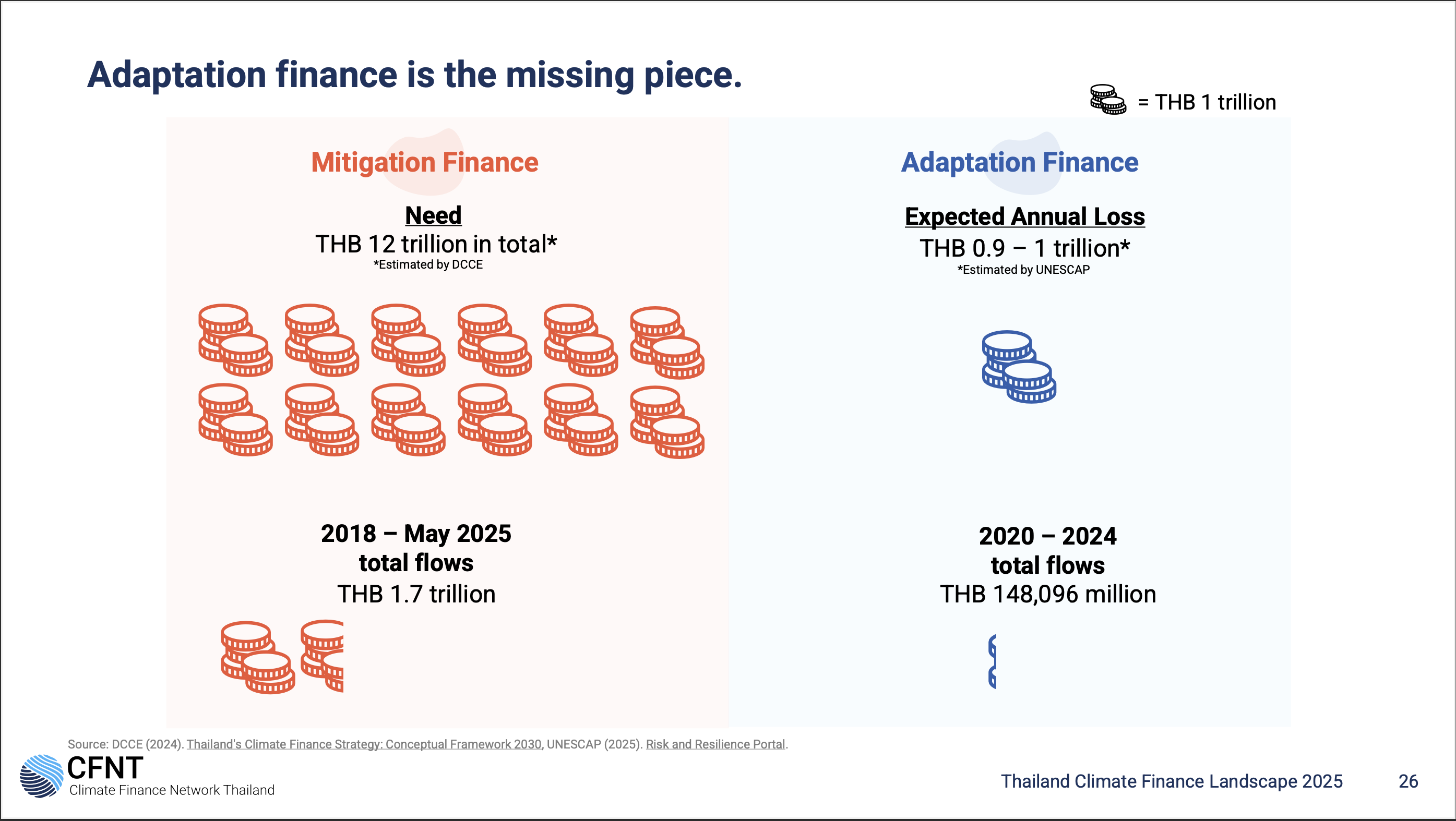

4. Adaptation receives less than 10% of mitigation funding.

Between 2020 and 2024, only 148.1 billion THB was invested in adaptation efforts, which is less than 10% of mitigation funding. This is alarming, given Thailand’s vulnerability to climate risks and the billions lost annually to disasters.

5. Most adaptation funding goes to water management.

Nearly 72.2% of adaptation finance is spent on irrigation and flood prevention, followed by urban resilience measures and sustainable agriculture (3.9%).

6. Private sector leads mitigation, while government dominates adaptation.

- 97% of adaptation funding comes from government agencies.

- Over two-thirds of mitigation funding (1.1 trillion THB) comes from the private sector, indicating its readiness to invest in the green economy. However, the private sector’s role in adaptation remains limited.

The Role of International Finance — and Thailand’s Opportunities

The Department of Climate Change and Environment estimates that Thailand will require 12 trillion THB in additional funding to meet its climate targets. UNESCAP further estimates that climate-related losses in Thailand could reach 1 trillion THB annually. This underscores a massive funding gap that must be bridged through both domestic and international finance.

CFNT researchers found that Thailand has significant untapped potential to attract international climate finance — for example, by engaging multilateral development banks (World Bank, ADB) and initiatives like the Just Energy Transition Partnership (JETP), which have played critical roles in neighboring countries’ energy transitions.

“Thailand has so far received very little from international development banks and funds, even though these institutions are major players in energy transitions across Southeast Asia. This is an opportunity Thailand must seize,” Thanida emphasized.

For Downloading CFNT Presentation: