Climate change is not a challenge confined to any one country—it’s a global mission that demands a unified vision to safeguard our shared home for future generations.

At the closing session of the ‘2025 Climate Finance Tracker: Uncovering Thailand Flows‘, hosted by the Climate Finance Network Thailand (CFNT) on July 21, representatives from the United Nations Environment Programme (UNEP) and Thailand’s Department of Climate Change and Environment (DCCE) shared their urgent calls for multi-sectoral action in addressing climate change.

How do global institutions view the climate crisis? And how prepared is Thailand for the low-carbon transition? Here are the key takeaways.

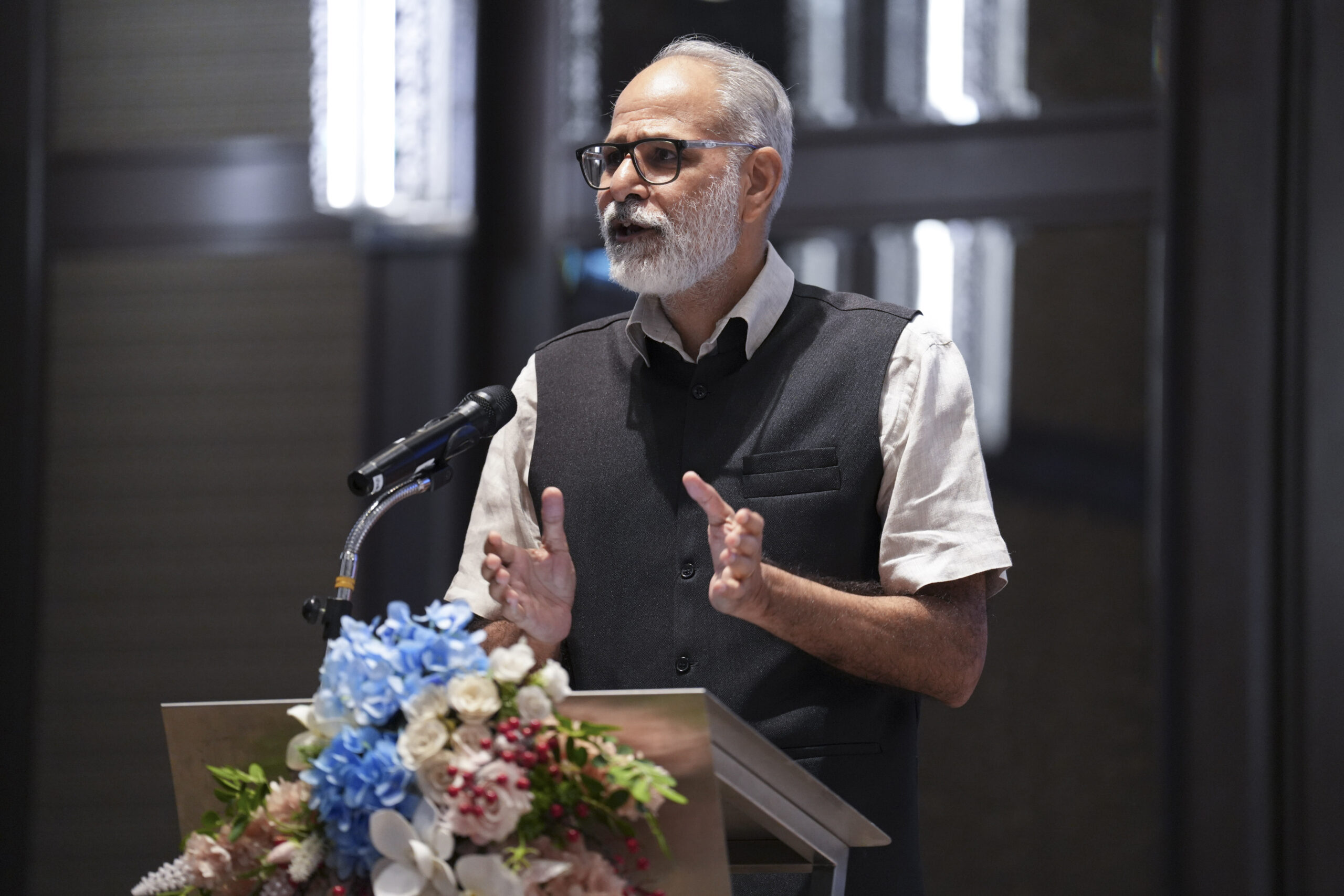

Engaging the Private Sector in Climate Action – Sudhir Sharma

Sudhir Sharma, Regional Coordinator Finance and Economic Transformation at UNEP, began by highlighting the global economic risks posed by climate change. He warned that climate impacts could result in a global loss of capital of up to 13 trillion USD, potentially reaching 18 trillion USD by 2030.

Despite the dire numbers, Sudhir expressed optimism. According to the UNEP’s Emissions Gap Report, the world already possesses the technological capacity to limit global warming to below 2°C. For economic side, EV sales are growing rapidly—reaching 17.1 million units in 2024, a 25% increase from the previous year. Meanwhile, renewable energy generation continues to rise, with global capacity reaching 5,500 GW in 2020—a threefold increase in just five years.

While these developments signal progress, Sudhir emphasized the critical role of strategic financial flows. “Finance needs to move in the right direction,” he noted, “and this can only happen through transparent, accurate, and accessible data.” He praised CFNT’s Thailand Climate Finance Tracker for its contribution to closing financial gaps and steering capital toward effective climate mitigation and adaptation efforts.

He added that UNEP FI actively works with banks, insurers and asset managers in supporting adopting Net Zero goals and build capacities to enable the transition. It is actively collaborating with ASEAN countries on the ASEAN Adaptation Taxonomy, which will make it easier to categorize climate finance activities—such as which funds are used for mitigation and which for adaptation.

Sudhir outlined three key priorities for strengthening climate finance:

- Align finance with climate goals

All sectors—especially the private sector—must stop funding fossil fuel-related activities and shift investments toward genuine climate adaptation and resilience projects. Also, governments should use their funds strategically through blended finance approaches to crowd-in private sector rather than giving subsidies or grants to all actions.

- Mandatory transparency and reporting

Governments must introduce mandatory climate-related financial disclosures. UNEP, for instance, has advocated for climate budget tagging, and calls on regulators to require transparent reporting of climate-related expenditures—by both companies and public institutions—without compromising privacy, to improve climate finance tracking.

- Clear policy signals for the private sector

Governments must send clear signals to direct private capital. For example, Thailand’s 30@30 policy, which sets a target of producing at least 30% zero-emission vehicles by 2030, provides long-term guidance for private investment and helps align financial flows with climate priorities.

Thailand’s Five-Pillar Climate Strategy – Dr. Kittisak Prukskanon

Dr. Kittisak Prukkanone, Director of the Division of Strategy and International Cooperation at the Department of Climate Change and Environment (DCCE), Ministry of Natural Resources and Environment, outlined the Thai government’s vision of building a unified climate action ecosystem—and acting as a major investor in the country’s green transition.

He presented five key areas of focus in DCCE’s climate finance and policy strategy:

- Establishing a dedicated environmental budget

DCCE is working with the Budget Bureau to create an environmental budgeting mechanism—similar to national water or economic budgets—to improve clarity and efficiency in environmental spending. - Green public procurement (GPP)

Government procurement systems are being updated to prioritize environmentally friendly products and services, laying the foundation for a greener economy. - Setting environmental standards

DCCE is expanding eco-labeling schemes such as G-Green+ for SMEs, along with labels for carbon footprints and sustainable products, to promote greener production practices across sectors. - Revising Thailand’s NDC (3.0)

Thailand is revising its Nationally Determined Contributions (NDCs) to move its net-zero emissions target from 2065 to 2050, reflecting stronger national ambition. The updated report is expected to be submitted by September 2025, ahead of COP30 in Brazil.

“I often compare setting net-zero targets to weight loss, We can no longer afford to ‘gain more weight before dieting.’ The planet can’t wait—we must stop emitting now.” said Dr. Kittisak.

He further noted that Thailand has concluded that international climate finance is essential for the green transition. The government aims to finance 70% of the transition domestically, while seeking 30% support from international partners.

“The world must see that we’re serious, To attract international support, we need to prove our commitment to real climate action.” he said.

- Drafting the Climate Change Act

The forthcoming Climate Change Act will serve as Thailand’s legislative foundation for climate governance. It covers five key components Climate policy and planning, Greenhouse gas reduction, Climate adaptation, Financial mechanisms and Enforcement and penalties

Dr. Kittisak stressed the importance of climate finance mechanisms under this law. The government will pool general tax revenues—such as corporate tax and VAT—with new carbon-related instruments (e.g., carbon taxes or Emissions Trading Schemes) to redistribute funds into green initiatives. These may include targeted subsidies, green loans, or equity financing for vulnerable communities and decarbonization projects.

“We studied models from countries both wealthy and developing to design a finance system suited to Thailand,” said Dr. Kittisak. “Trust the public sector—we would never pass a law that hurts our own people.”

While the numbers may paint a challenging picture, both Sudhir Sharma and Dr. Kittisak Prukskanonagreed: Thailand and the world are headed in the right direction. And as long as we continue down this path, the light at the end of the tunnel will become clearer.

Download DCCE Slides: DCCE-CFNT