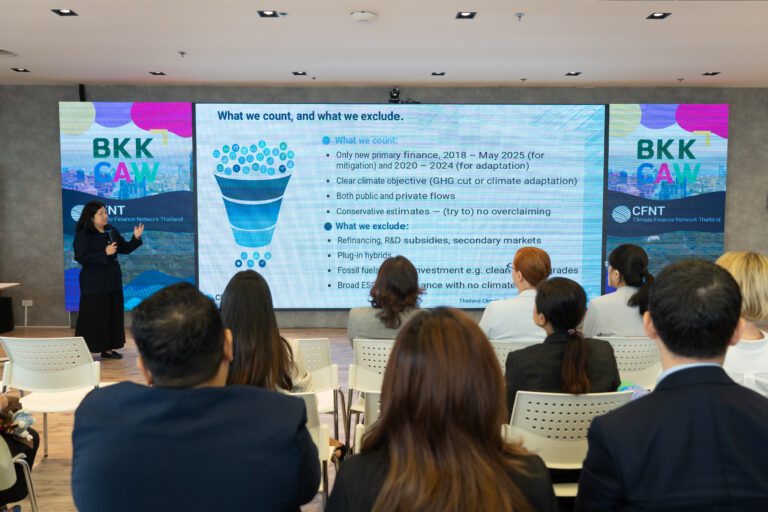

How Thailand’s Local Governments Invest in a Climate Change?

Thailand is one of the most vulnurable country in climate chage, a key question arises: How is Bangkok and other local governments allocating their budgets to address climate change, and how far are we from meeting the country’s climate finance goals?