On Febuary 5, 2024, Climate Finance Network Thailand (CFNT) hosted its inaugural webinar, providing an overview of the climate finance landscape. The event featured a lecture by Dr. Ornsaran Pomme Manuamorn, CFNT Technical Advisor. Dr. Ornsaran is an accomplished development practitioner and researcher, specializing in climate change, sustainable development, and sustainable finance. She has over 19 years of work experience with international development organizations with project experience from Southeast and South Asia.

Before delving into the concept of climate finance, Dr. Ornsaran emphasized the importance of understanding two key climate actions: mitigation and adaptation. Mitigation involves reducing greenhouse gas (GHG) emissions, while adaptation entails measures to cope with existing negative climate impacts. For instance, investing in renewable energy addresses mitigation, whereas building irrigation systems addresses adaptation to climate-induced sea level rise.

Dr. Ornsaran defined climate finance as investments, programs, and activities aimed at both mitigation and adaptation, aligning with the United Nations Framework Convention on Climate Change (UNFCCC) definition. She underscored the potential synergies between mitigation and adaptation actions, highlighting examples like retrofitting buildings to improve energy efficiency while enhancing residents’ resilience to extreme climate events.

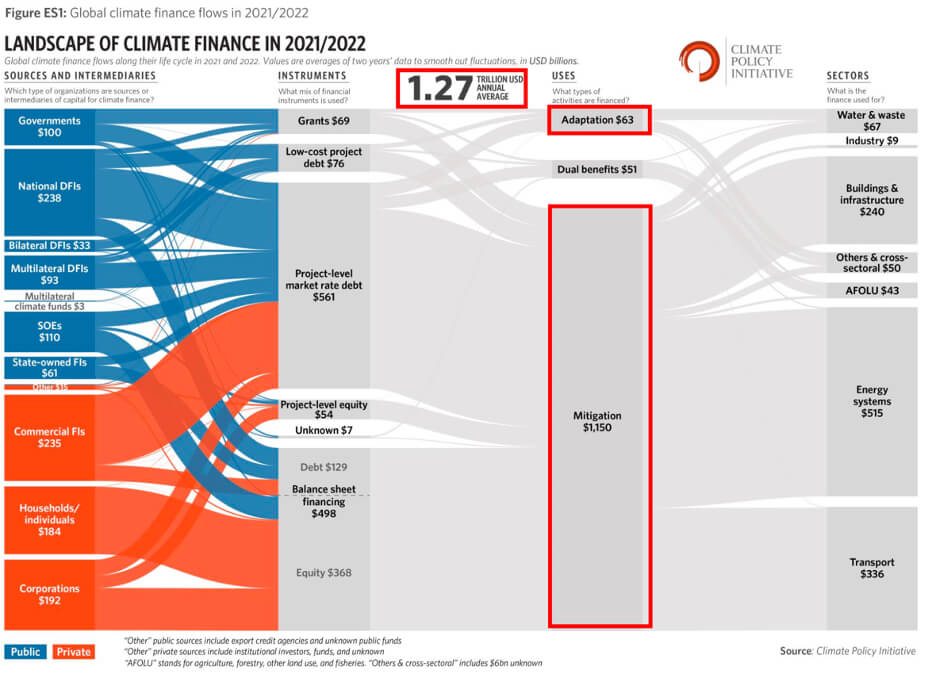

Zooming out to the global climate finance landscape, Dr. Ornsaran revealed that from 2021-2022 approximately US$1.27 trillion climate finance flows were allocated, with 90% directed towards mitigation and 10% towards adaptation. Notably, 70% of these funds come from domestic sources, with private sectors primarily driving mitigation finance and public sectors leading in adaptation investments.

Transitioning to Thailand, Dr. Ornsaran outlined substantial investment needs, estimating US$23 billion for bio-circular and green economy (BCG) sectors and US$355 billion for decarbonizing the economy across all sectors. Reflecting global trends, the private sector predominantly finances climate mitigation, particularly in energy, transportation, and industrial sectors, while the public sector prioritizes adaptation, focusing on water resource management, agriculture, public health, tourism, and human settlements.

The climate expert informed the audience about various foreign sources of climate funding investing in Thailand, which can be categorized into three main types. Firstly, mitigation investments span across IPPU, multi-sectoral, energy, and transport sectors. Secondly, adaptation investments primarily focus on water management, followed by human settlement and agriculture. Thirdly, funding for projects aimed at enhancing the enabling environment, with the highest proportion allocated to institutional strengthening, followed by mechanisms and instruments.

In the public sector, Dr. Ornsaran highlighted two significant adaptation projects receiving foreign funding. Firstly, the Green Climate Fund, in partnership with the United Nations Development Program (UNDP), targets sustainable water management and agriculture. Similarly, the Adaptation Fund, in collaboration with Vietnam, focuses on agricultural development in the Mekong River Basins. These investments aim to establish resilient natural environments crucial for combating climate change, including activities such as watershed reforestation and mangrove forest restoration. Additionally, a housing project funded by the Global Environment Facility (GEF) under the mitigation theme aims to construct energy-efficient housing, establish green housing standards, and promote increased adoption of green housing in Thailand.

Dr. Ornsaran also highlighted Thailand’s private sector, where green bonds rank second in ASEAN after Singapore, primarily focusing on the energy and building sectors. These bonds serve as mitigation finance, targeting greenhouse gas emissions reduction, especially in energy and transportation. She added that Climate Bonds Initiative (CBI) studies show several climate-aligned bonds contributing to mitigation efforts, even if not explicitly labeled as green. Moreover, financial products like Sustainability Linked Loans (SLLs) and ESG (Environmental, Social, and Governance) bonds are increasingly favored as transition finance in Thailand, particularly targeting energy, transportation, and agriculture, including bank bonds supporting reforestation, aligned with mitigation investments in Agriculture, Forestry, and Other Land Use (AFOLU).

Concluding the webinar on an optimistic note, Dr. Ornsaran mentioned that Thailand has completed its first Taxonomy to define green investments, with plans to expand it to include more sectors, further promoting mitigation and adaptation finance. She emphasized the importance of broadening Thailand’s finance perspectives to incorporate social aspects, addressing equity issues and supporting vulnerable groups in short-term adaptations. Additionally, she highlighted the significance of biodiversity finance, with potential future funding emerging from both climate and biodiversity domains simultaneously. Dr. Ornsaran stressed the necessity of clear finance tracking methodologies and criteria for classifying climate finance to ensure transparency and avoid double counting.